THE DEAL RISK

Most JV and M&A failures are technology failures

In modern transactions, technology is no longer a support function — it is core deal value.

Yet during JVs and M&A, technology risk is often underestimated.

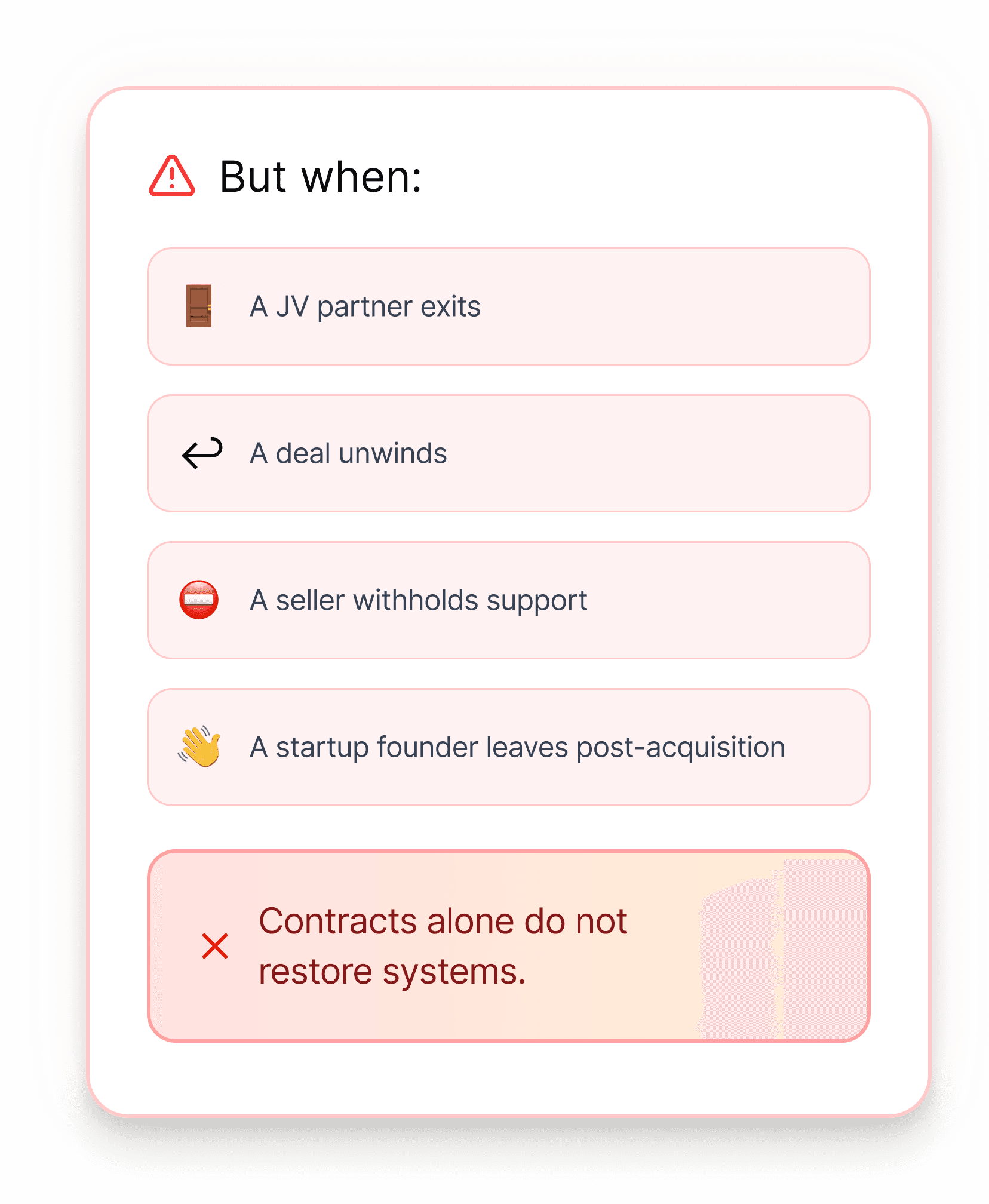

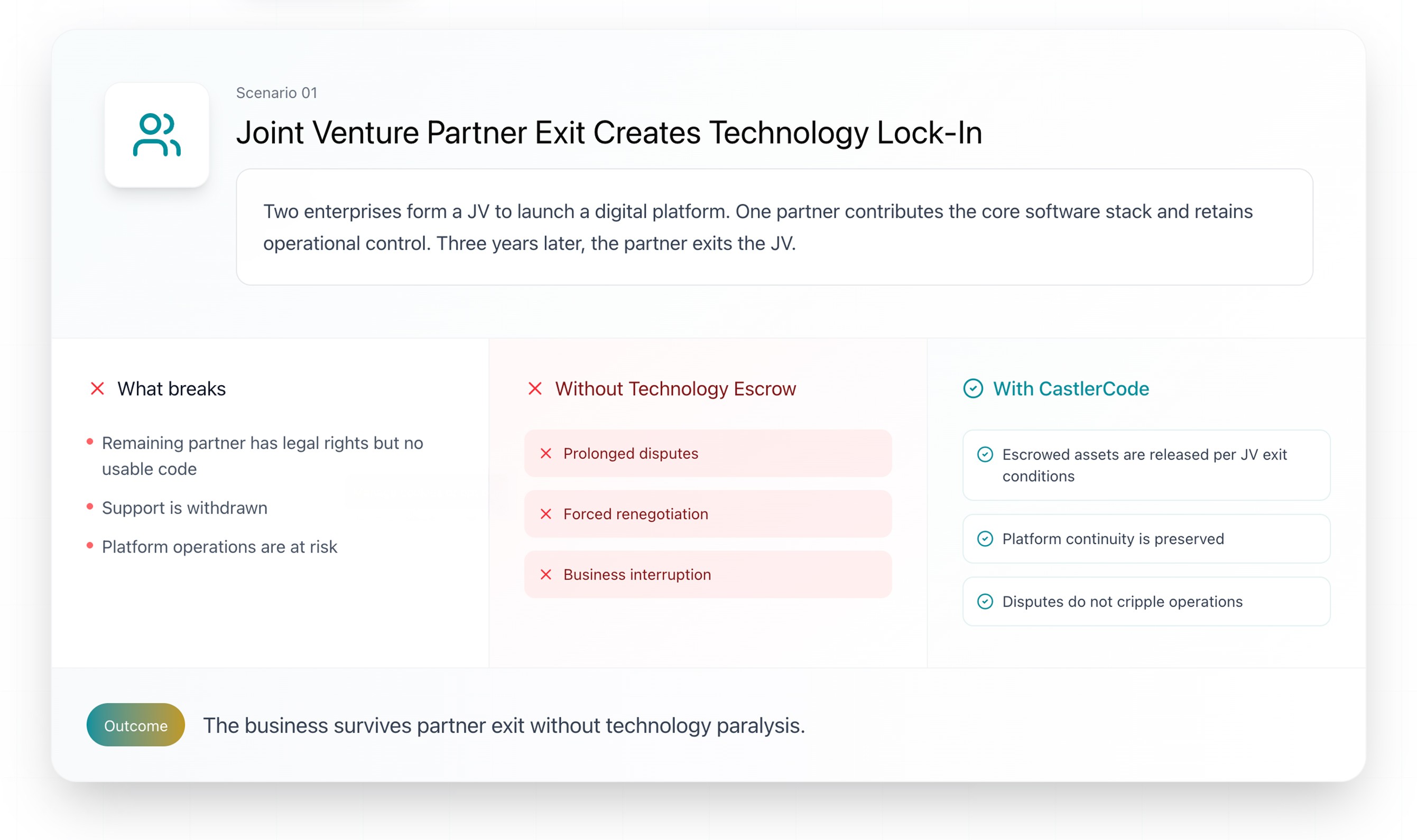

Common deal realities:

Source code is controlled by one party

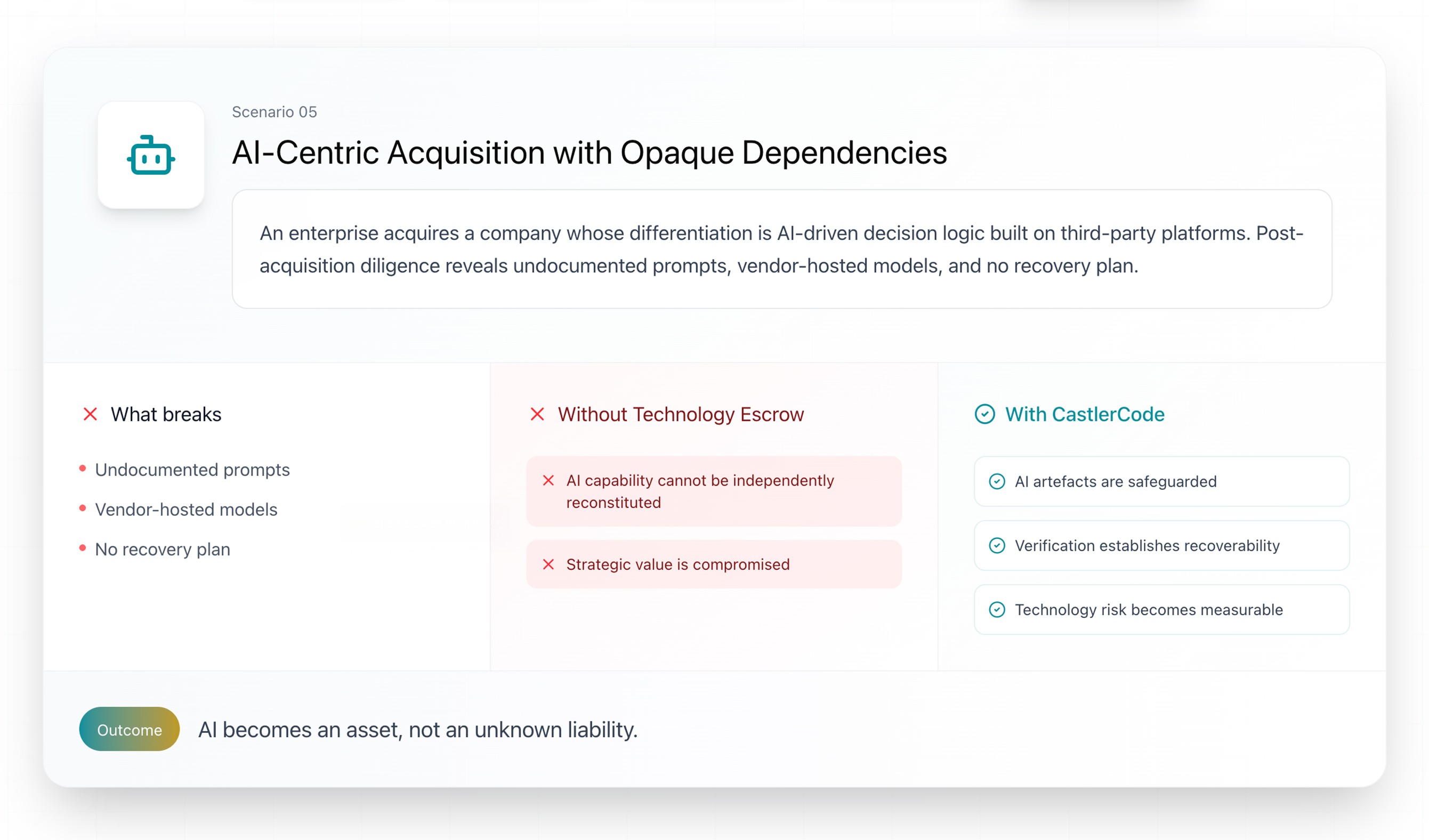

AI systems are undocumented or vendor-hosted

Critical software sits with a third-party vendor

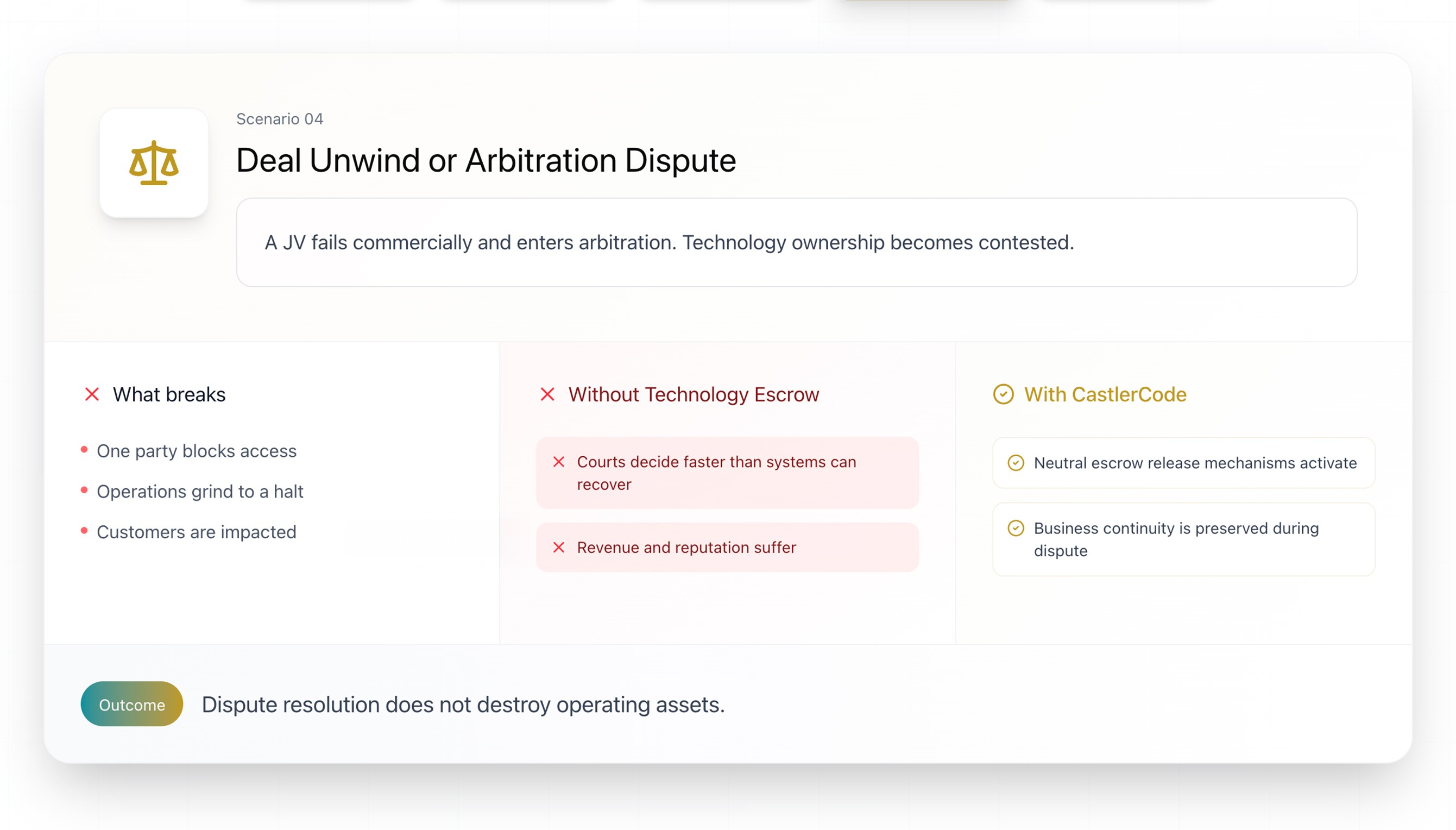

Shared platforms become disputed post-close

Exit clauses do not guarantee operational continuity

When this risk materialises, business continuity, valuation, and trust break down.

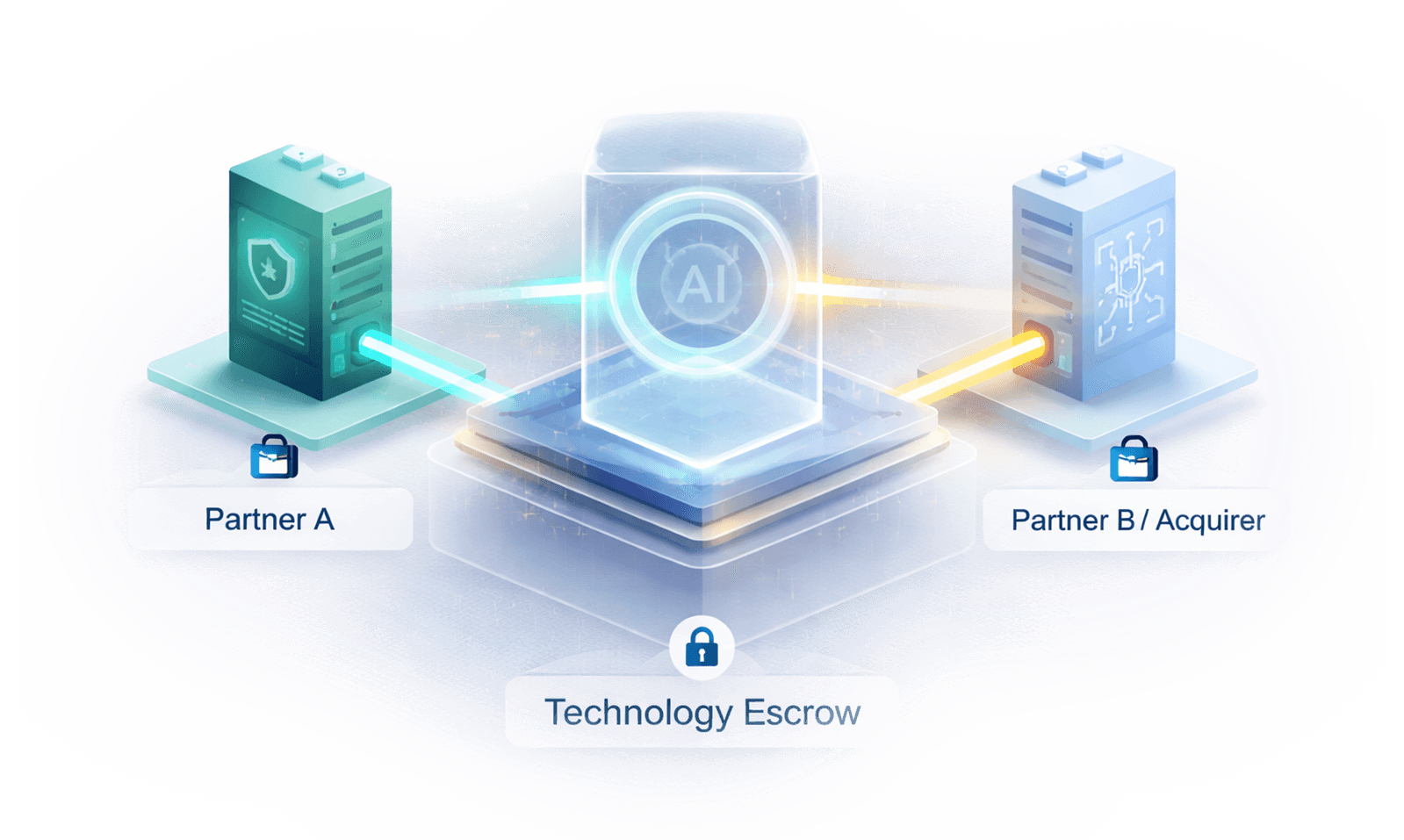

CastlerCode acts as a neutral technology continuity counterparty for JVs and M&A.

Source code and proprietary software

AI models, prompts, and decision logic

Deployment configurations and dependencies

Documentation required for operational takeover

Confirms that all required AI artefacts exist and are within scope:

Models and weights

Prompts and agents

Pipelines and dependencies

Key question answered:

Is everything that defines the AI system actually safeguarded?

Level 2 – Integrity and

Currency Verification

Assesses whether AI systems can be meaningfully reconstituted in real continuity scenarios.

Focuses on:

Operational usability

Survivability under stress

Practical recovery assumptions

Key question answered:

Can this AI system actually function if the vendor disappears?

WHO THIS IS FOR

Joint ventures and strategic alliances

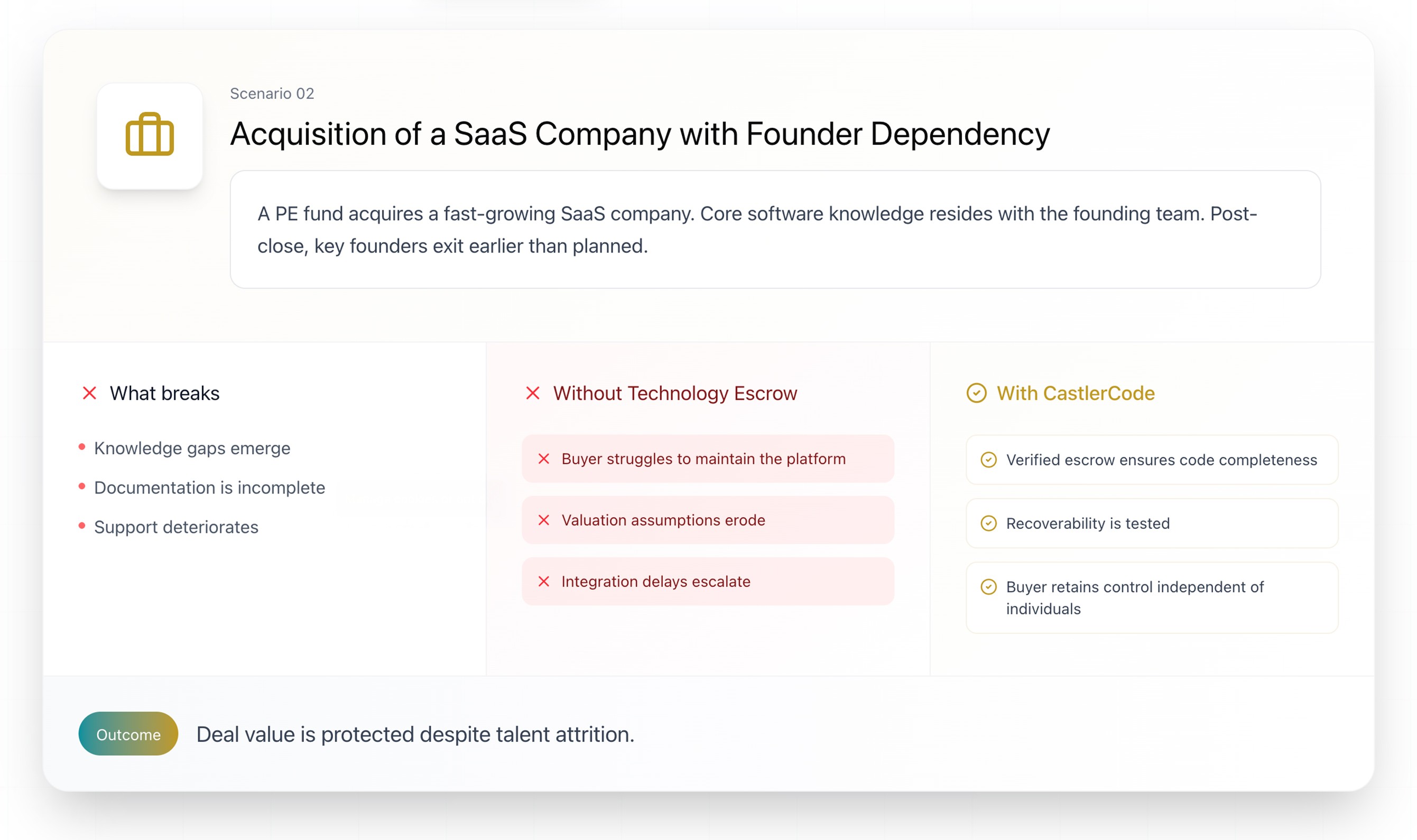

Mergers and acquisitions

Private equity and venture capital investments

Corporate carve-outs and restructurings

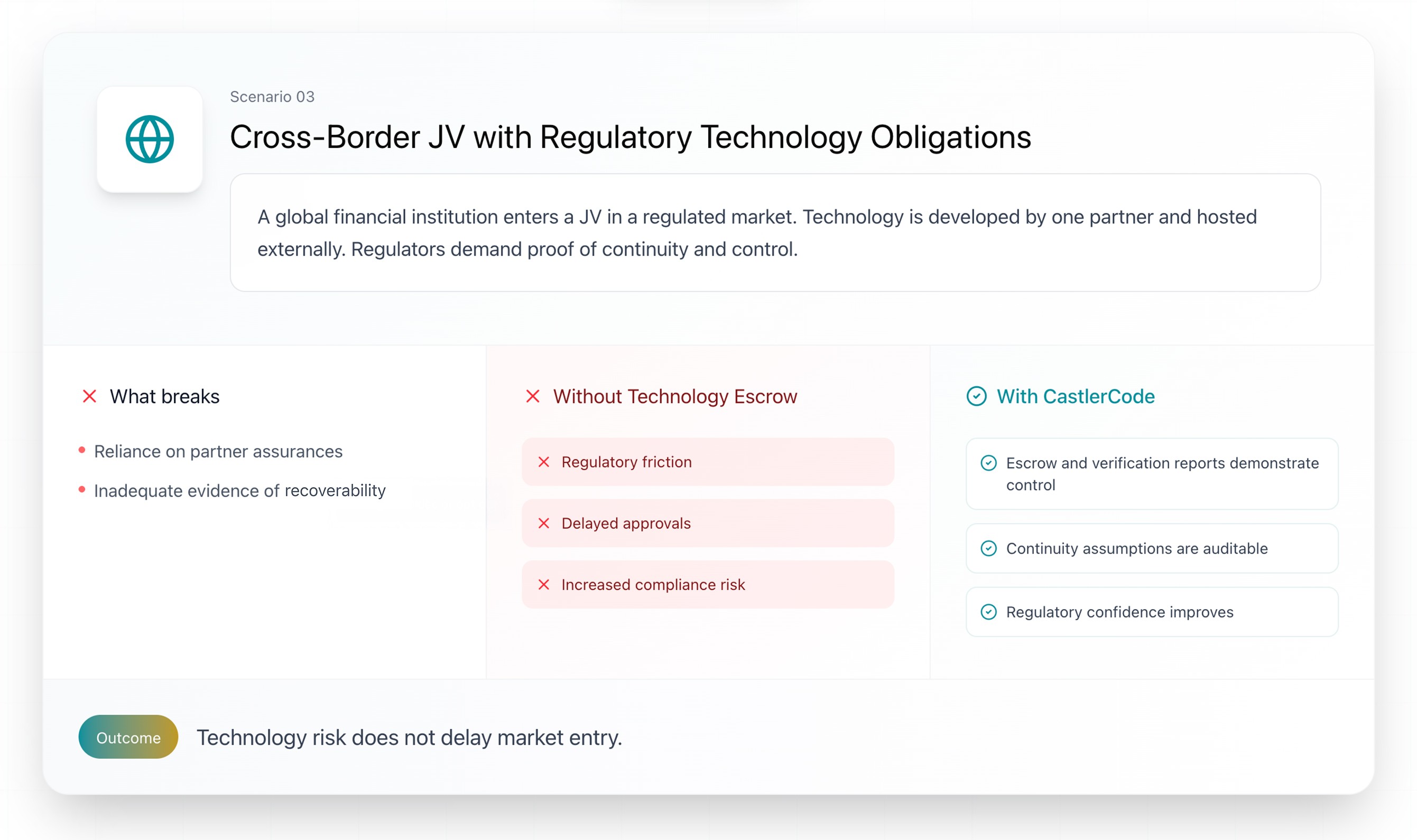

Cross-border and regulated transactions

Used by:

Corporate development

teams

CISOs and technology

leaders

Investment committees

& boards

Legal and IP teams

Designed for scrutiny, not assumptions

Multi-jurisdictional transactions

Regulator-facing continuity requirements

Audit-ready governance

Dispute-resistant release mechanisms

Partner exits

Founder departures

Legal disputes

Regulatory scrutiny

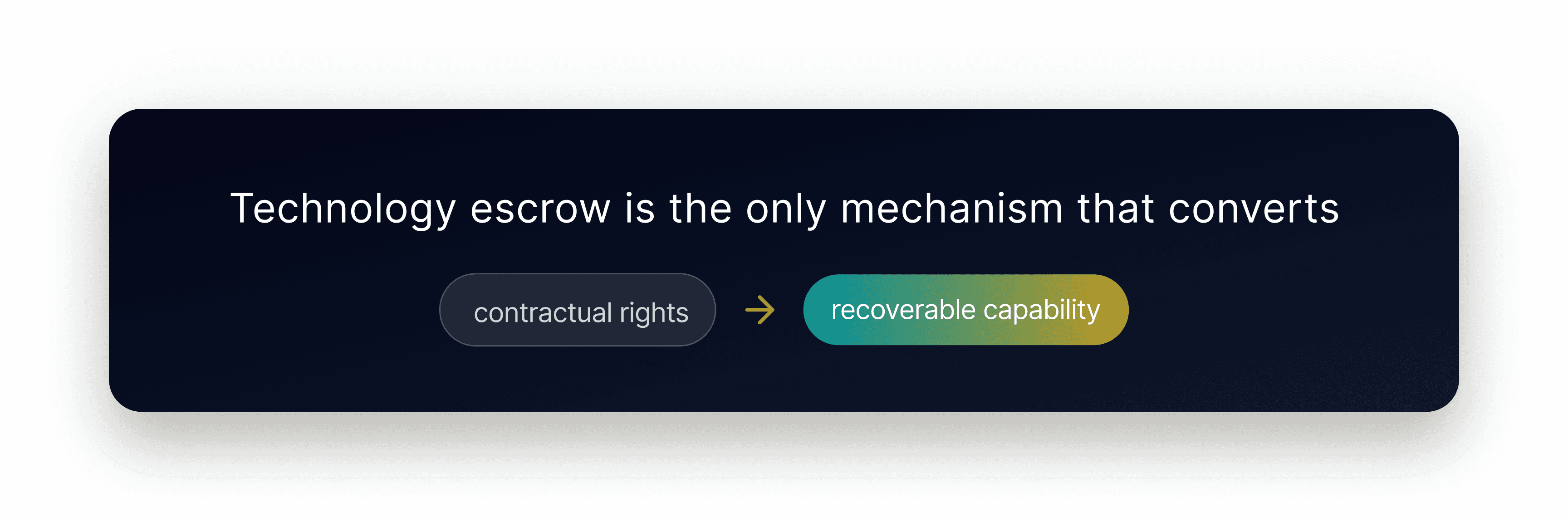

JV and M&A transactions fail when technology continuity is assumed instead of engineered.

Talk to our experts to understand how CastlerCode protects technology assets before, during, and after complex transactions.

Talk to an Expert